U.S. Natural Gas Storage Full? Here's a Secret...

The dirty little secret is: It ALWAYS gets full. This year's dramatic drop in natural gas prices from their December highs started way back in January when we had the warmest period on record and used up very little of last year's storage (more on that in a minute). And yet during September the market seems to have been surprised by the fact that we are sitting at end of the gas injection season with nearly full storage again. Everyone knew this back in April. We all knew spot prices would fall as storage came closer to full as the marginal unit of gas output had fewer options as to where it could be stored or sold. Like others, we thought there could potentially be another big hurricance season to take more gas offline, but we weren't counting on it. What bothers me is that people, often very smart people, act now as if this near-term storage impaction has anything to do with the long-term economics of the natural gas exploration and production business. Stock prices for these companies have fallen hard as the market has taken near-term data and extrapolated it too far into the future. So now lets review why gas prices may be low now but why that has little to do with what prices will likely be next summer or next year, or over the next five years...

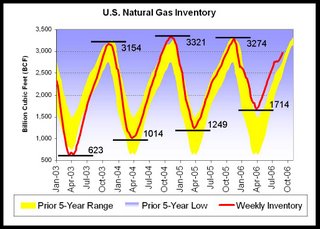

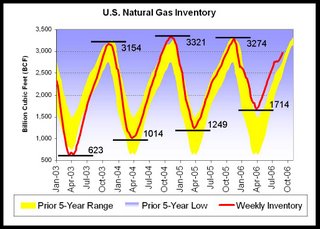

You hear alot of people saying the natural gas bull run is over because storage is getting full. To repeat myself: it always does. See the chart below:

The yellow band represents the range of high-to-low storage for any given week during the prior five years (on a rolling basis). The red line represents actual weekly reported storage. Note that the yellow band gets narrower at the top as the years go by...this is an indication that the amount of storage at year-end (just before the winter withdrawal season begins) tends to fall in a narrow range. You can also see this by looking at the tops of each year. There you see that we tend to have about 3200-3300 billion cubic feet (bcf) of gas in storage at end of season, even though the beginning of each year can be dramatically different - from an extreme low of 623 bcf in April 2003 to 1714 bcf in April 2006. So my point is still this: we always get full. The question is: At What Price?

The yellow band represents the range of high-to-low storage for any given week during the prior five years (on a rolling basis). The red line represents actual weekly reported storage. Note that the yellow band gets narrower at the top as the years go by...this is an indication that the amount of storage at year-end (just before the winter withdrawal season begins) tends to fall in a narrow range. You can also see this by looking at the tops of each year. There you see that we tend to have about 3200-3300 billion cubic feet (bcf) of gas in storage at end of season, even though the beginning of each year can be dramatically different - from an extreme low of 623 bcf in April 2003 to 1714 bcf in April 2006. So my point is still this: we always get full. The question is: At What Price?

Pricing and motivations

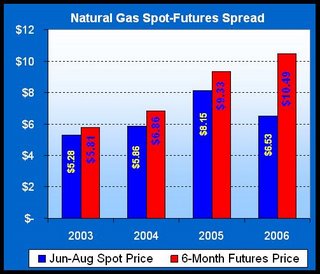

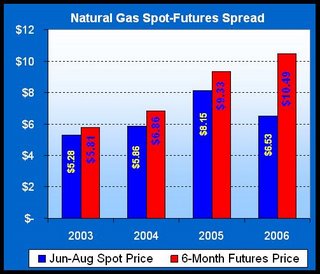

Natural gas buyers (utilities, industrial users, etc.) buy gas in summer and store it for winter when deliverability from existing production isn't high enough to meet high demand for winter heating, etc. If the price of gas in summer, plus the cost to store it, is less than the expected price in winter, then buyers have an incentive to buy and store. So buyers with an option to store gas look at the summer-winter spread and will buy gas in summer opportunistically as prices weaken. Some buyers will programatically buy regardless of price since they have contractual obligations to have a certain amount in storage. In each of the prior years, the spread between summer spot sprices and the futures prices (expectations) for gas in winter were fairly stable:

Source: Bloomberg data for Henry Hub Spot and generic NG6 future

Source: Bloomberg data for Henry Hub Spot and generic NG6 future

In 2003, it took just a $0.53 spread between the average summer spot price and the winter futures to manage to add 2531 bcf into storage. We got full, at an average price of $5.28 that summer. That was a historic year as gas prices had never stayed that high in summer before - that high price was needed because we were starting out with such a low amount.

In 2004, it took a $1.00 spread to incentivize a build of 2307 bcf to get to full storage.

In 2005, it took a $1.18 spread to incentivize a build of 2025 bcf to get to full storage

And in 2006 we will likely get to 3500 bcf, adding 1786 bcf during a summer when the spread averaged $3.96 ! Is it any wonder that users are buying now and putting into storage for winter? It is cheaper now and we should not be surprised that storage will be full.

But, does full storage therefore tell you anything about the long-term supply-demand fundamentals for natural gas? I would contend that is does not.

What you should notice is that the operators who used to be able to buy gas in the summer cheaply can't do that as easily anymore. The winter users now must compete with the summer users, namely the electric utilities that use natural gas to generate electricity, especially when it gets really hot and natural gas-fired "peaking" plants generate a great deal of incremental electricity.

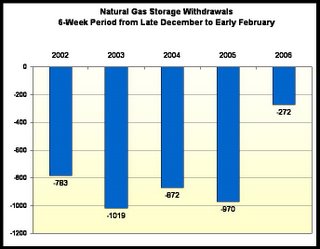

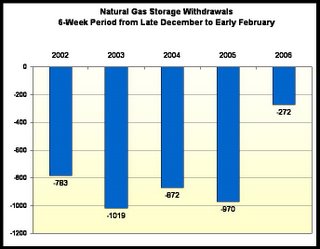

I mentioned that we had an abnormally warm winter last season. To put it in perspective, you should note that winter use of natural gas has a big "fat spot" of use during the 6-week period from mid-December to Early February. Take a look at the data shown here, you'll see that a normal winter would see withdrawals of gas from storage that averages around 900 bcf for this "core" 6-week period. Yet this year, with a record-warm January, we only used 272 bcf:

The point being that we started out with a lot of gas in storage, but only because we had a warm winter. We built to full storage, but only becasue of high prices and an attractive spread. Moreover, if we hadn't had that 700 bcf overhang from a warm winter, we might be sitting here now wondering what type of price it will take to get to full storage.

The point being that we started out with a lot of gas in storage, but only because we had a warm winter. We built to full storage, but only becasue of high prices and an attractive spread. Moreover, if we hadn't had that 700 bcf overhang from a warm winter, we might be sitting here now wondering what type of price it will take to get to full storage.

Once you consider that we can't really predict weather with any accuracy, you must realize two things:

1) Natural gas prices will remain very volatile, and dependent on weather.

2) Storage levels are a weak indicator of long-term prices.

We believe that it requires long-term natural gas prices in excess of $7.00 per mcf in order to generate meaningful returns on most drilling programs in the U.S. This is based on finding and development costs, operating costs, etc., that we won't get into right now. That is later. For now, just be wary of anyone who relies on storage numbers to predict the future.

For those who want to know more about storage, the U.S. DOE has a report titled "Estimates of ...Working Gas Storage Capacity".

You hear alot of people saying the natural gas bull run is over because storage is getting full. To repeat myself: it always does. See the chart below:

The yellow band represents the range of high-to-low storage for any given week during the prior five years (on a rolling basis). The red line represents actual weekly reported storage. Note that the yellow band gets narrower at the top as the years go by...this is an indication that the amount of storage at year-end (just before the winter withdrawal season begins) tends to fall in a narrow range. You can also see this by looking at the tops of each year. There you see that we tend to have about 3200-3300 billion cubic feet (bcf) of gas in storage at end of season, even though the beginning of each year can be dramatically different - from an extreme low of 623 bcf in April 2003 to 1714 bcf in April 2006. So my point is still this: we always get full. The question is: At What Price?

The yellow band represents the range of high-to-low storage for any given week during the prior five years (on a rolling basis). The red line represents actual weekly reported storage. Note that the yellow band gets narrower at the top as the years go by...this is an indication that the amount of storage at year-end (just before the winter withdrawal season begins) tends to fall in a narrow range. You can also see this by looking at the tops of each year. There you see that we tend to have about 3200-3300 billion cubic feet (bcf) of gas in storage at end of season, even though the beginning of each year can be dramatically different - from an extreme low of 623 bcf in April 2003 to 1714 bcf in April 2006. So my point is still this: we always get full. The question is: At What Price?Pricing and motivations

Natural gas buyers (utilities, industrial users, etc.) buy gas in summer and store it for winter when deliverability from existing production isn't high enough to meet high demand for winter heating, etc. If the price of gas in summer, plus the cost to store it, is less than the expected price in winter, then buyers have an incentive to buy and store. So buyers with an option to store gas look at the summer-winter spread and will buy gas in summer opportunistically as prices weaken. Some buyers will programatically buy regardless of price since they have contractual obligations to have a certain amount in storage. In each of the prior years, the spread between summer spot sprices and the futures prices (expectations) for gas in winter were fairly stable:

Source: Bloomberg data for Henry Hub Spot and generic NG6 future

Source: Bloomberg data for Henry Hub Spot and generic NG6 futureIn 2003, it took just a $0.53 spread between the average summer spot price and the winter futures to manage to add 2531 bcf into storage. We got full, at an average price of $5.28 that summer. That was a historic year as gas prices had never stayed that high in summer before - that high price was needed because we were starting out with such a low amount.

In 2004, it took a $1.00 spread to incentivize a build of 2307 bcf to get to full storage.

In 2005, it took a $1.18 spread to incentivize a build of 2025 bcf to get to full storage

And in 2006 we will likely get to 3500 bcf, adding 1786 bcf during a summer when the spread averaged $3.96 ! Is it any wonder that users are buying now and putting into storage for winter? It is cheaper now and we should not be surprised that storage will be full.

But, does full storage therefore tell you anything about the long-term supply-demand fundamentals for natural gas? I would contend that is does not.

What you should notice is that the operators who used to be able to buy gas in the summer cheaply can't do that as easily anymore. The winter users now must compete with the summer users, namely the electric utilities that use natural gas to generate electricity, especially when it gets really hot and natural gas-fired "peaking" plants generate a great deal of incremental electricity.

I mentioned that we had an abnormally warm winter last season. To put it in perspective, you should note that winter use of natural gas has a big "fat spot" of use during the 6-week period from mid-December to Early February. Take a look at the data shown here, you'll see that a normal winter would see withdrawals of gas from storage that averages around 900 bcf for this "core" 6-week period. Yet this year, with a record-warm January, we only used 272 bcf:

The point being that we started out with a lot of gas in storage, but only because we had a warm winter. We built to full storage, but only becasue of high prices and an attractive spread. Moreover, if we hadn't had that 700 bcf overhang from a warm winter, we might be sitting here now wondering what type of price it will take to get to full storage.

The point being that we started out with a lot of gas in storage, but only because we had a warm winter. We built to full storage, but only becasue of high prices and an attractive spread. Moreover, if we hadn't had that 700 bcf overhang from a warm winter, we might be sitting here now wondering what type of price it will take to get to full storage.Once you consider that we can't really predict weather with any accuracy, you must realize two things:

1) Natural gas prices will remain very volatile, and dependent on weather.

2) Storage levels are a weak indicator of long-term prices.

We believe that it requires long-term natural gas prices in excess of $7.00 per mcf in order to generate meaningful returns on most drilling programs in the U.S. This is based on finding and development costs, operating costs, etc., that we won't get into right now. That is later. For now, just be wary of anyone who relies on storage numbers to predict the future.

For those who want to know more about storage, the U.S. DOE has a report titled "Estimates of ...Working Gas Storage Capacity".

0 Comments:

Post a Comment

<< Home