In my last post, I discussed the timeline for electric vehicle (EV) adoption and the need for natural gas as a fuel that enables the transition from an oil-based transportation economy to an electric-based one. To reiterate: I'm a believer in the future of EVs: I own one EV and have another on order. But I'm also a realist, with my own decisions being driven by data and science.

So I restate this from the prior post: we will need natural gas as a "lesser of evils" fossil fuel for the next 10 years (at least), and realistically much longer. But you only have to believe me for the next 5 years to understand my thesis on why we are in a multi-year bull market for companies that produce natural gas.

Key summary points:

1) Natural gas is the most dominant component of electric production in the US

2) If you believe in EV adoption, you can't wish away natural gas drilling (see prior post Titled "Electric Vehicles, Adoption Timelines, and Electric Power Generation" )

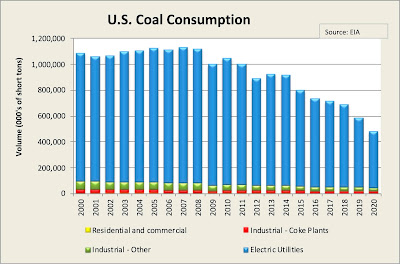

3) Natural gas has been and will continue to be a key fuel to reduce our need to burn coal, which is still almost 20% of electric generation in the US, and coal is by far the biggest carbon emitter in the portfolio of US electric generation assets

4) As renewables like Solar and Wind grow as a proportion our electric generation, natural gas plants are often needed as backup generation due to the intermittent nature of the renewables

5) The USA is the largest producer of natural gas in the world

6) Natural gas (at large scale) in the USA is cheaper than almost anywhere in the world

7) Natural gas production companies have reduced drilling activity significantly in the last 10 years. They have had little incentive to grow as low prices have existed for over 5 years.

8) We over-produce gas in summer (and store it) and then use the storage in winter, because demand in winter exceeds daily production capacity. Right now, natural gas in storage is the lowest we have ever seen in summer for many years: partly due to long-term increased demand from electric generation and partly due to seasonal peak demand increases during this hot summer.

9) With low inventories and winter coming, it looks like we won't fill storage to what we need in order to have enough excess gas in winter.

10) Natural gas prices on the spot market in August are higher than they have been in many years, encouraging more production, but new drilling isn't increasing fast enough. The drillers are very cautious as they've been through many boom and bust cycles.

11) The US is drastically increasing its ability to export more natural gas to places like Asia and Europe, where prices are far higher. This is not a new phenomenon, it's been gaining speed for years due to natural gas prices in the US being close to $2 per million cubic feet (MCF) for several while they are over $15 to $30 per MCF in other parts of the world

12) Looking at the companies that drill for a produce natural gas, most are valued as if gas is still $3-$4, even though it's over $9 on the spot market and likely to remain high (over $5-6) for this year and years to come.

13) If you're interested in these companies, look at SWN, EQT, RRC, DVN, CRK, CHK, and others. They tend to get traded like oil companies, even though most of them produce mainly natural gas, not crude oil.

So, that's the summary, here is some data on those various points:

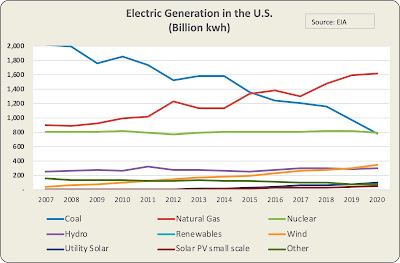

Gas for electricity: As discussed in the prior post, electric generation in the US has significantly changed in the last 20 years. Natural gas has displaced coal, with gas now powering about 40% of the grid, while nuclear has stayed steady around 20% and renewables have grown from virtually nothing to a total of about 13%. Coal has dropped from a whopping 50% just 20 years ago to about 15% today. As electric demand increases, so will the need for natural gas AND renewables, to meet growth as well as to displace coal.

Largest Producer: US has a strategic and technical advantage in natural gas: The US produces more natural gas than anyone on the world, and we have the world's largest reserves. This partly due to the nature of the underlying geology of the US and in large part due to the technology that the US has developed for horizontal drilling and fractionation of reservoirs with "tight" rock, including shale-based oil and gas.

Worldwide gas demand increasing: As the world grows, and as it needs more power from sources other than coal and renewables, gas is the preferred source. Worldwide demand has grown 66% in the last 20 years, while China's demand has grown 1370% in the same period. Europe has grown as well, by depending on supplies from places like Russia and Ukraine, which have recently proven to be a strategic mistake for Europe.

Exports from the US are expanding: Gas is not as easy to move around the world as oil is. For long-distance transport, it must be liquefied using an expensive process in large LNG (liquefied Natural Gas) plants. It must then be transported in special LNG ships, and re-gassified in more expensive plants at the point of import. That infrastructure builds slowly but has helped increase exports from the US, and will continue to grow, bring the US abundance of gas to countries that desperately need it. At the time I write this, natural gas in Europe and China is roughly 4 to 8 times more expensive than in the US. The world needs our exports. The chart below shows the growth recently, and keep in mind that this was before the Russian invasion of Ukraine.

Drilling is constrained: US oil and gas production companies have significantly reduced the number of drilling rigs deployed in the US looking for gas. Prices have been low for many years, hovering under $2 per MCF for long enough that many producers went bankrupt or had to restructure. Companies are now more debt-averse and less likely to "drill, baby, drill" as prices rise. In 2008, at the last big spike in prices, companies had over 1500 rigs drilling for natural gas (see red line below). That number has now been under 200 rigs for the last 7 years and hasn't increased dramatically since prices started rising a year ago. Yet production stays high: how? That is because the average rig today drills better wells than 10 and 20 years ago (and no dry holes - virtually all wells are successful). Today's large onshore wells can produce 20,000 - 30,000+ MCF a day at initial production, compared to 2,000 to 5,000 just 10 years ago. Technology advancements and frac improvements account for the massive increases in productivity. So, 30-50 extra rigs now make a big difference.

Storage is extremely low: Natural gas demand is higher in winter, historically, than in summer. We traditionally store gas in summer and use that excess in winter, which generally leads to higher prices in winter than in summer. But with more gas being used for electricity in summer (more electricity from gas now than ever, more houses with air conditioning), summer demand has increased, making it harder to fill gas in summer, unless prices stay high to encourage more supply. So far in summer 2022, prices have been very high and yet demand is still high and supply isn't enough to fill gas storage. Our storage is at an extremely low level and isn't filling fast enough to ensure proper excess for Winter. The chart below shows the storage amount today of about 2400 Billion cubic feet. Compare that red line to where we were the last few years and you will see why summer gas prices remain high. We are struggling to fill inventory for Winter.

Prices are high: Spot gas prices have risen from $3.75 per MCF last year at this time to over $9.00 per MCF today. That is the highest summer gas price we've seen since 2008, just before the financial crisis, and in 2005 when Hurricanes in the Gulf of Mexico destroyed or hampered a large amount of US offshore natural gas production. Note the yellow shaded areas below. Those are the Winter price spikes that occur when we have cold Winter snaps and the country needs more gas to heat homes. If the gas can't get there through the pipelines fast enough, prices rise. 2021 was unusual, with significant pipeline issues in Texas.

August Price Winter Spike

2016 $2.75 $3.60

2017 $2.90 $6.20

2018 $2.77 $4.50

2019 $2.19 $2.60 (warm winter, high storage, no big spike)

2020 $1.80 $23.86 (Texas freeze issues)

2021 $3.93 $6.70

2022 $9.20 $ ??

Why you might like natural gas stocks: Most Wall Street Analysts are using natural gas prices of between $4.50 and $5.00 for generating estimates for fiscal 2023. So earnings per share (EPS) estimates for most of the companies that produce gas are significantly under-estimated at this point. Estimates will likely continue to be increased as the months move along, creating a tailwind for the stocks of these companies. Looking back at the last 12 months (4 quarters) of earnings shows that these companies are, in many cases, trading at price/earnings (P/E ratios) of about 3x to 10x.

Take a look at companies like Chesapeake Energy (CHK), Devon Energy (DVN), Range Resources (RRC), Southwestern Energy (SWN), Equitable (EQT), and Comstock Resources (CRK). I'm not suggesting you buy any of them, but note that these are often traded as if they primarily produce oil (they tend to run up and down with the energy ETF trading), and yet these are companies focused primarily on natural gas and the natural gas liquids derived from them (propane and ethane, for example). Most are trading as if gas is $4.50 and they are being afforded a low P/E ratio for valuation. I think many investors see the current natural gas situation as short-term and based on things like Ukraine. I think I've made the case above that there is much more going on here.

Chesapeake Energy, for example, had $4.87 in EPS in Q2 and $3.09 in Q1 and analysts expect the company will generate $15.00 in EPS in 2022. Selling at $100 per share, the company is trading at about six times earnings (P/E ratio of 6), and that is having sold gas at an average price well below where prices are today. Next year' earnings are expected to bin in the range of $19 per share (average analyst expectations) which are generally using prices under $5.00 or $6.00 per mcf to establish those estimates. Also note that these company's earnings can look more volatile than the really are, due to some terrible accounting rules dealing with commodity hedging (see my old post called "Hedge Accounting is Distorting the Reality of Oil and Gas Earnings".

CHK is just one example, but the whole group has shown to be throwing off tremendous free cash flow and they have all been focused on returning capital to shareholders through buybacks and dividends. They are also focused more on ESG initiatives, being better stewards of the environment, and significantly reducing methane emissions from operations. All which must happen. Because for now, we need gas. These companies have changed their stripes and are not pouring everything back into drilling, which can often lead to destruction of shareholder value when prices inevitably decline. And they do.

I have always said: that "the cure for high prices is... high prices. And the cure for low prices is... low prices". Demand and supply just take a while to get back to equilibrium. For me, I'm suggesting that equilibrium is going to take several years, based on the data presented above. Winter is coming.

Labels: energy equities, energy stocks, gas prices, natural gas, natural gas inventory, natural gas investments, natural gas prices, natural gas stocks, oil and gas stocks